This November marks the 19th anniversary of Long-Term Care Awareness month, presenting an opportune time to discuss why Long-Term Care insurance [LTCi] should be considered a vital part of one’s financial plan.

Long-Term Care insurance is an essential part of any financial plan. The costs of long-term care are not covered by health insurance, Medicare, or disability insurance, and Medicaid requires individuals to deplete their lifetime savings before being eligible for benefits.

With the population of the United States aging at a rapid rate, people living longer than ever before, and retirement funding becoming an increasingly personal responsibility, many are beginning to realize that one of the biggest threats to their retirement income and savings is the potential cost of a long-term care situation.

LTCi presents the perfect solution to bridge this gap in coverage, protecting hard-earned retirement income and assets. The costs of long-term care are high and rising, but LTCi can provide the peace-of-mind that one’s retirement can remain in-tact should the need for services ever arise.

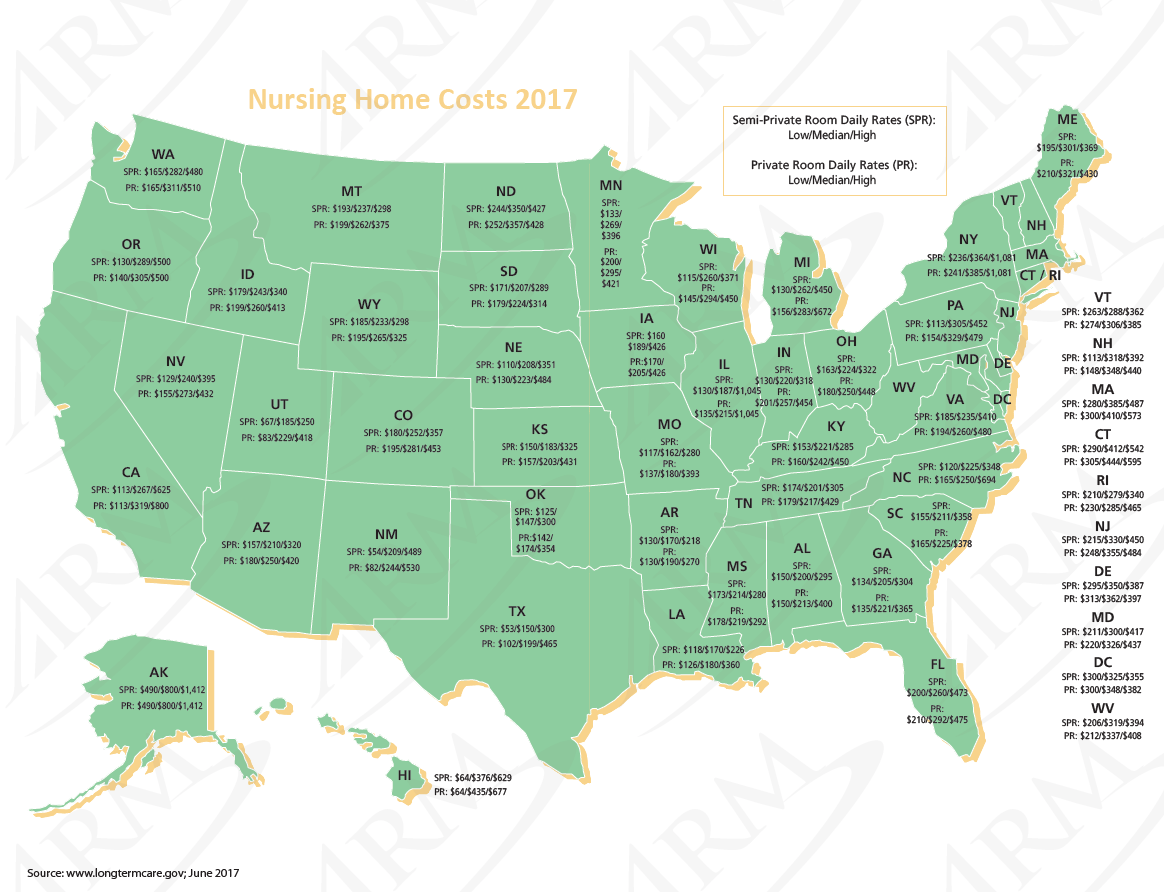

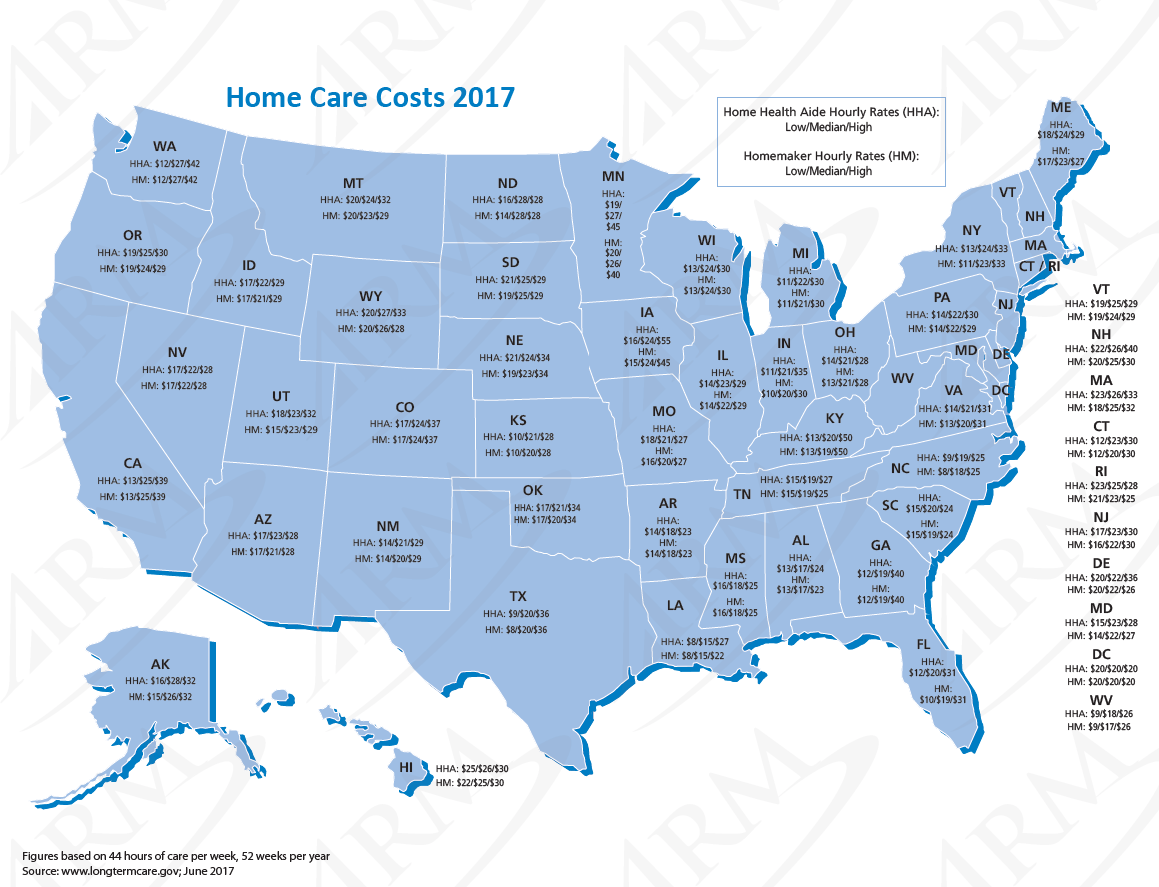

See below for the current costs of long-term care services:

By: Advanced Resources Marketing

About Advanced Resources Marketing (ARM):

Founded in 1986, we are one of the Nation’s largest marketers of Long-Term Care insurance [LTCi].

We believe that distribution is at the core of any successful venture, and we continue to provide our clients with our experience and expertise in an ever-changing industry.

We are an independent agency who works with all industry constituents in the areas of distribution, education & thought leadership, and marketing & sales.

We work with established and start-up institutions in the financial services industry including regional & national professional affinities and their members, with employers and their employees, and insurance agencies and their agents & brokers.

As an independent agency, we are unique in our comprehensive approach to distribution. Our flexibility and unrivaled professional staff allow us to continuously provide our clients best-in-class tailored services and corresponding results.

-CMYK.png?width=250&name=LifeSecureLogo(F)-CMYK.png)

.png?width=860&height=245&name=Full%20Color%20Krause%20Group%20Horizontal%20(002).png)