Significant inflation - something that the majority of Americans have not seen in their lifetime - has been a primary news topic. From concerns about exploding national debt and high government spending levels to an expanding post-pandemic economy, many people are concerned about sustained inflation and decreased purchasing power. Or, as many economists are assuring us, this could be a short-term event as the economy bounces back from the pandemic. Nobody knows!

Of course, long-term care costs are not immune from inflation, including eye-popping increases in nursing home costs. The good news is that LTC Insurance can effectively mitigate much of the inflation risk through inflation riders. Read on for some strategies to guard against the future costs of inflation:

Estimated Future Cost of Care

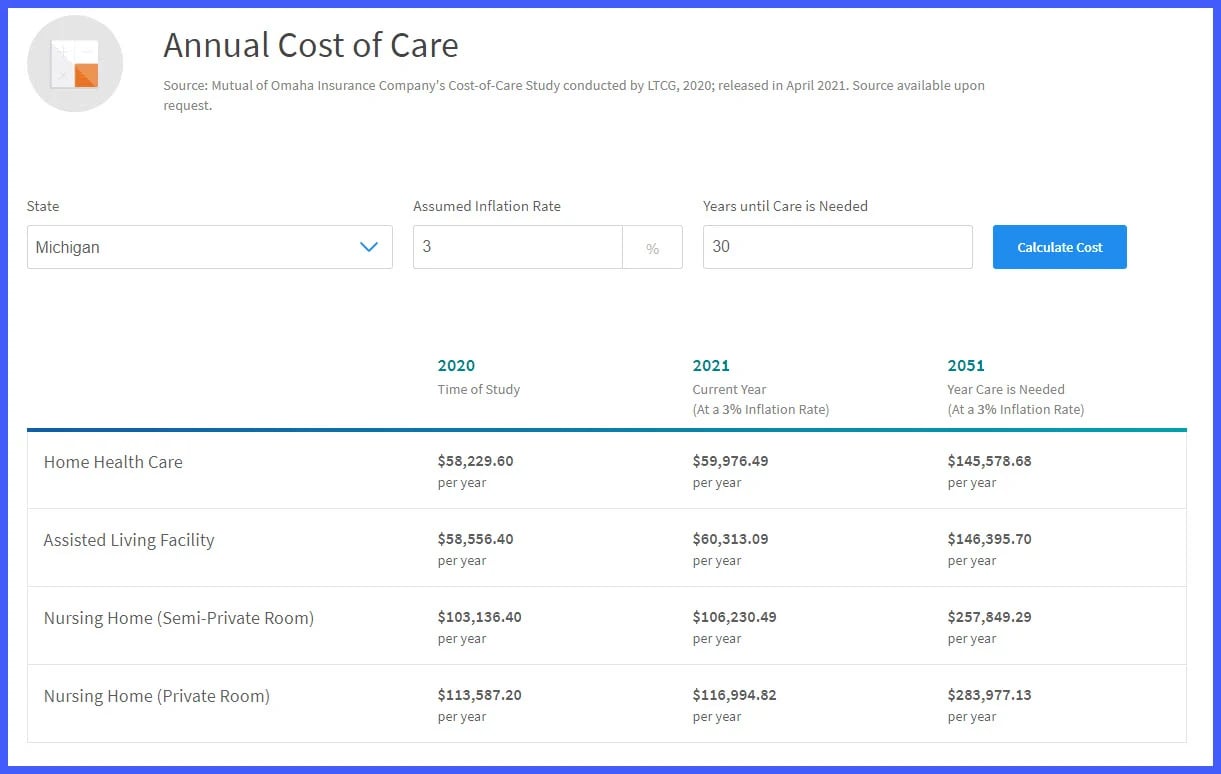

First and foremost, the only way to guard against long-term care inflation is to understand the inflation environment and how someone's current plan to finance care is performing. There are several resources to view historical LTC costs, and one of the best is the cost of care survey available through Mutual of Omaha - (here's a link). Their calculator lets you pick a state where care may be needed, enter an inflation rate, and estimate when care will happen.

Here's an example of a 55-year-old in Michigan who may need care at age 85. Note that most people design plans to cover the costs of home care and assisted living - both are similar at around $58K in today's dollars.

As we will see, these calculators can be very helpful when comparing inflation options and what type of benefits will be available at the most typical claim time.

Advice for existing LTC policyholders

If you are a current long-term care insurance policyholder, understanding the current cost of care can help you monitor how well your policy is performing. Advisors can help by conducting periodic (annual if possible) reviews of policies.

Often a rate increase letter will spur a conversation about current benefits. If you do receive a rate increase letter, carriers will often offer the option of decreasing the rate of future inflation increases. For example, a policy might have been purchased with 5% compound automatic inflation protection, and the policyholder may find that their benefit has increased substantially more than the current cost of care.

The rate increase letter the carrier sends out may give the option to decrease future increases at a lower rate- say 2%. If someone is older or in poorer health and potentially near a claim that might be a smart choice. However, if someone is in good health or younger it may make sense to either pay the premium increase OR reduce the daily or monthly benefit but keep the automatic inflation benefits the same.

Remember, LTC insurance carriers will always give you the chance to reduce benefits - but generally not increase benefits.

Advice for new policy buyers:

Long-term care insurance comes in three general flavors: Traditional LTC Insurance, Linked LTC + Life plans that offer an LTC extender on a hybrid life/LTC policy, and Life Insurance plans that allow you to accelerate the death benefit while living to pay for LTC. Let’s look at each product line and how they can be designed to keep up with inflation:

Traditional LTC Insurance Inflation Options

Traditional LTC Insurance provides pure protection against LTC costs with no death benefit or cash value. Most policies offer a number of inflation options, with the most popular (by far) being plans that automatically increase the daily or monthly LTC benefit by a 3% compound each year. Since the total benefit of LTC plans is calculated by multiplying the daily benefit by the number of plan years chosen, the total LTC benefit will increase over time.

If you look at historical LTC inflation trends of the last 20 years, 3% has been fairly accurate and is a safe purchase. However, for those concerned about inflation, they may want to consider the more costly 5% compound option - and someone could purchase a smaller initial benefit that will grow over time.

Want to save some premium dollars? Some companies offer as little as a 1% initial inflation option with the flexibility to increase that at a later date. Others will have the compounding inflation stop after a number of years- saving money but also lowering future benefits.

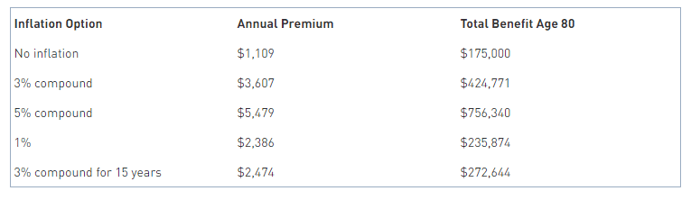

How will these options perform? Consider a 50-year-old married female in Illinois who buys a traditional LTC plan with an initial total benefit maximum of $175,000. Here's how different inflation riders will impact that total benefit pool at age 80:

As you can see, minor differences in plan designs and premiums can have a dramatic impact in later years. For example, deciding to save premium by stopping inflation growth after 15 years will have a dramatic impact at age 80 - and beyond. Considering what those benefits will be in the future is worth the effort.

Inflation and Linked Life + Long-Term Care Insurance plans

Another form of LTC Insurance is combination plans. There are two broad categories of these Life + Long-term Care plans. The first type are riders on permanent life policies that accelerate the death benefit if needed. In this case, the long-term care benefit is 100% dependent on what the life insurance benefit is at time of claim.

The second type of Life + Long-term Care includes LTC Insurance riders that provide an LTC benefit far beyond the life insurance benefit. These can be called linked, asset based, or hybrid plans. The products include OneAmerica AssetCare, Nationwide CareMatters, Lincoln MoneyGuard, Brighthouse SmartCare, Securian SecureCare.

Like traditional LTC Insurance, these plans all offer automatic inflation coverage. By law, LTC plans need to offer the 5% compound inflation option, and most also offer the popular 3% inflation option too. By using automatic inflation adjustments, the total benefits can keep up as the policyholder ages.

Non-guaranteed inflation benefits

Most inflation options are guaranteed - that is, you'll know exactly what the future benefit will be. However, carriers have developed products with benefit growth that will vary over time. Here are a couple of examples of inflation options that may fluctuate in the future:

- Medical CPI. The Nationwide CareMatters policy offers an automatic inflation option that is linked to the medical CPI index, with a premium for this option that is identical to the premium for 3% compound coverage. Each year the LTC benefit will increase by the medical CPI, with a cap of 6% and a floor of 0%. A separate ledger with a 2% compound inflation calculation is kept so at claim time a policyholder can receive the higher of the CPI amount or 2% compound.

- Inflation based on investment performance. Two hybrid life/LTC long-term products have features that increase the long-term care benefit based on market performance. The first is the Indexed Universal Life Policy from Brighthouse called SmartCare. In addition to the 5% compound option, you can choose an increase based on the S & P 500 index (or other indexes). Lincoln Financial offers a Variable Universal Life solution called MoneyGuard Market Advantage. The Life and LTC benefit can increase over time with market performance.

Both the Brighthouse and Lincoln products have LTC benefits that are locked in annually so that the LTC benefit pool doesn't decrease. Both of these products may illustrate substantially higher increases in LTC benefits at older ages with the caveat that those amounts are just projections.

Inflation is unpredictable - but long-term care insurance benefits don't have to be. Preparing for long-term care is important in any inflation environment.

-CMYK.png?width=250&name=LifeSecureLogo(F)-CMYK.png)