Long-Term Care Awareness month often encourages reflection about wellness, leading people to evaluate how they are prepared for the future the future – both physically and financially.

These days, many companies are shifting towards an overall wellness portfolio in their benefits offerings, promoting programs that encourage both health-related and financial wellness.

For those who wish to head into the future with the peace-of-mind that they are ready for whatever life throws at them, financial preparation can be boiled down to three main pillars – health insurance, retirement income, and Long-Term Care insurance [LTCi].

The importance of health insurance and retirement income are well-known, but many will overlook the importance of LTCi, which picks up where the other two pillars leave off. One of the biggest threats to the retirement plan is the cost of long-term care services, and since health insurance does not cover these expenses, LTCi allows individuals to protect their hard-earned (and often precisely allocated) retirement income and maintain financial security.

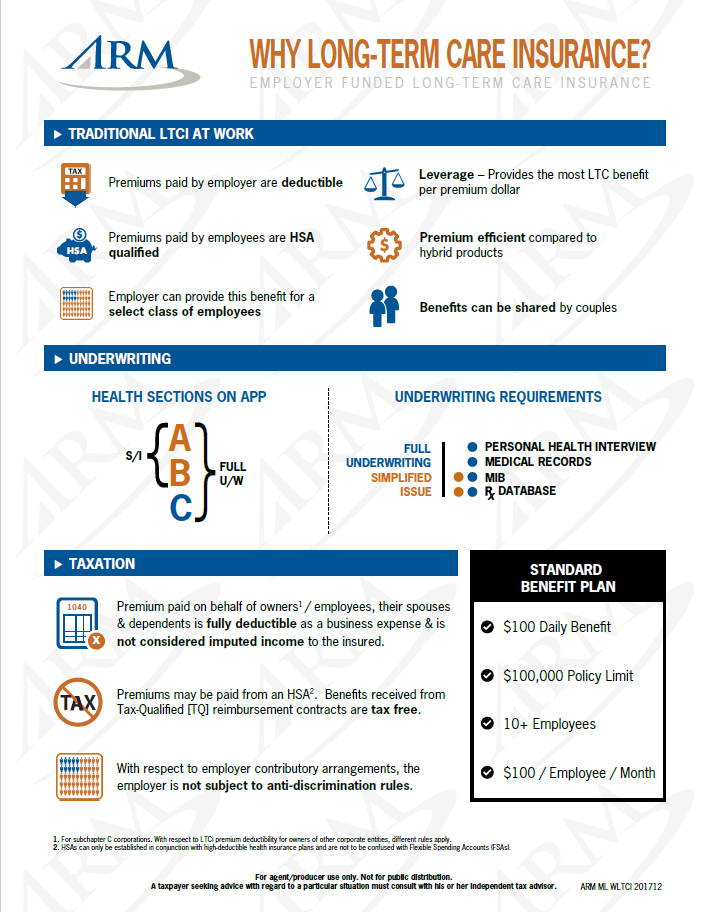

If you work with Employer clients, here's more information on why LTCi should be added to an employer’s benefits offering:

-CMYK.png?width=250&name=LifeSecureLogo(F)-CMYK.png)

.png?width=860&height=245&name=Full%20Color%20Krause%20Group%20Horizontal%20(002).png)