Following a period of substantial growth from the 1990s to 2010, Traditional LTC Insurance has encountered difficulties in expanding over the past decade. While sales remain steady, they are not significant enough to address America's Long-Term Care funding crisis. This has been highlighted by various negative press articles, including one from the New York Times' "Dying Broke" series in November 2023.

5 min read

The Challenges and Future of Traditional Long-Term Care Insurance

By Tom Riekse Jr. on 2/5/24 6:24 PM

Is Worksite LTCI Dead or Alive?

By NAIFA on 11/22/23 10:36 AM

Wondering if large-worksite traditional long-term care insurance is dead or alive? Kevin Sypniewski, founder and president of AGIS Network, a speaker at our recent “Don’t Be Scared of Long-Term Care” event says it depends on who you asks, and provides his insights on the answers and options.

Looking to learn more? The original presentation during “Don’t Be Scared of Long-Term Care” is available on demand. Media coverage of Kevin Sypniewski's presentation can be found in InsuranceNewsNet.

1 min read

Decoding Long-Term Care Insurance: Simplified Choices for Complex Needs

By NAIFA on 11/9/23 10:06 AM

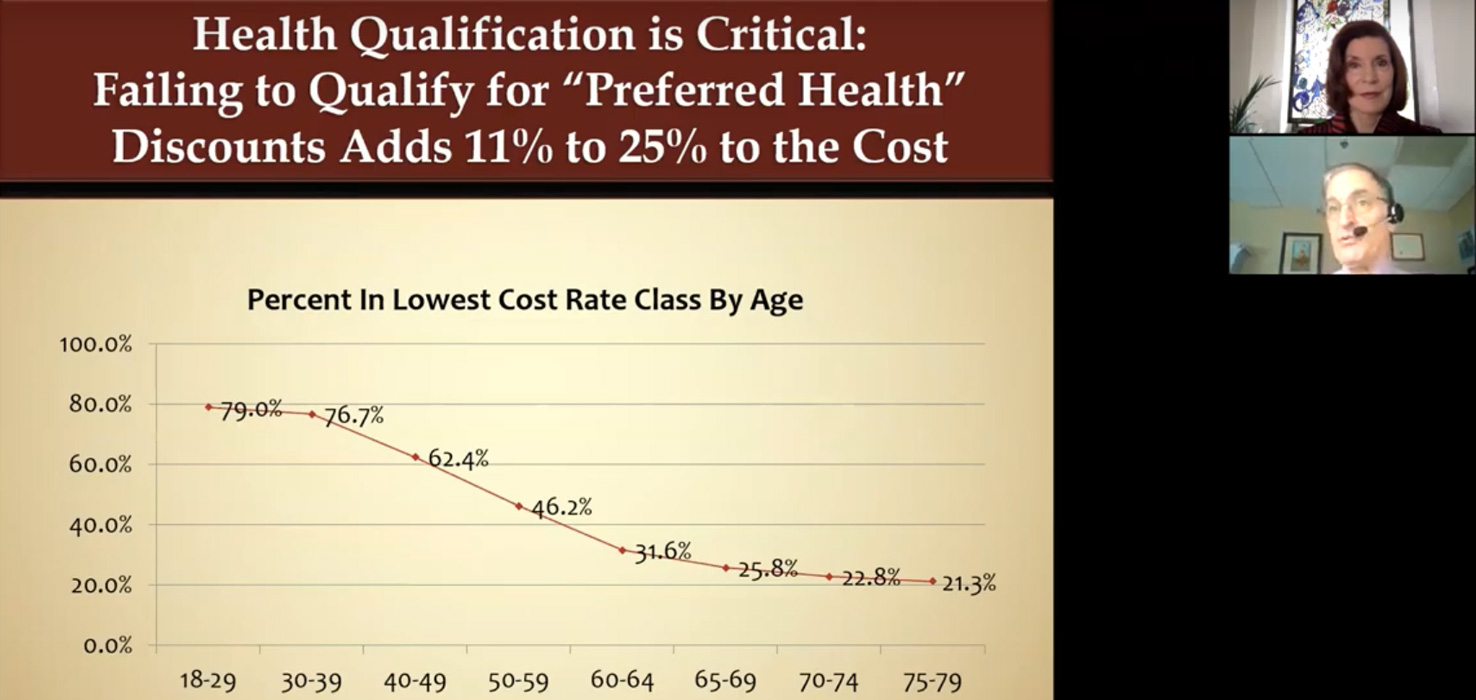

As part of Long-Term care awareness month our latest spotlight highlights the insights from Tom Riekse’s article on Long-Term Care (LTC) insurance. He breaks down the often overwhelming array of options into manageable choices, guiding through the intricacies of health underwriting, product features, and funding strategies. To get the full breadth of Tom's expertise, read his in-depth article.

3 min read

It's Long-Term Care Awareness Month: Make Sure Your Clients Prepare for Any Eventuality

By NAIFA on 11/2/23 10:56 AM

November is National Long-Term Care Awareness Month and it is a great time to bring potential limited and extended care planning needs top-of-mind with your clients. It is important for every comprehensive financial plan to include LTC considerations. So even if LTC insurance is not your primary line of business, Long-Term Care Awareness Month gives you a good opportunity to get clients up to speed.

3 min read

This Halloween, There's Nothing to Fear about Long-Term Care

By NAIFA on 10/5/23 9:20 PM

Before you head out for Trick-or-Treating, spend the afternoon preparing for Long-Term Care Awareness Month with NAIFA's Limited and Extended Care Planning Center. Executive Director, Carroll Golden, CLU, ChFC, CLTC, CASL, LECP, FLMI hosts a Halloween event, Don't Be Scared of Long-Term Care. This free event will feature some of the biggest names in the limited and long-term care space.

1 min read

California Insurance Department FAQ Aims to Clear Up Confusion About LTCi Program Study

By NAIFA on 8/18/23 1:19 PM

California has not at this time established a publicly funded state-run long-term care insurance program or set deadlines for employees in the state to opt out. The state established a Task Force to study the possibility of such a program and make recommendations, and that study is ongoing. The California Department of Insurance has issued a revised Frequently Asked Questions Document to clear up some common misconceptions. Among topics covered by the FAQ are:

1 min read

46% of Financial Professionals Don't Recommend LTC Insurance

By NAIFA on 7/20/23 5:19 PM

A study conducted by OneAmerica found that 46% of financial professionals do not recommend long-term care (LTC) protection to their clients.

The study highlights a potential gap in helping clients prepare financially for potential LTC expenses. It is estimated that almost 70% of individuals over the age of 65 will require LTC services at some point in their lives, making LTC protection an important aspect of retirement planning.

7 min read

Your Wealthy Client Can Self-Insure for Long-Term Care. But Should They?

By Tom Riekse Jr. on 6/6/23 12:12 PM

Let me ask you a question. How much will your long-term care cost?

The answer, of course, is you have no idea. You may be one of the lucky ones who are completely independent and dies of "natural" causes in their sleep. Or you may be diagnosed with early-onset Alzheimer's and need expensive care for a number of years. It's not unusual for people to spend up to $20,000 per month on long-term care (I've got family experience).

It's often said that LTC Insurance is for the middle class - the poor can rely on Medicaid to pay for care and the wealthy can pay for care themselves. But is self-insuring, or to be more precise self-funding, always the best choice?

4 min read

Paying for Senior Care

By Coventry on 5/23/23 3:00 PM

As you get older and develop medical conditions, you may need to consider getting assistance in the form of senior care. From in-home care to an assisted living or nursing facility, there are many options that can meet your needs. But the unfortunate reality is that senior care often comes with a high price tag, and you need to know what costs to anticipate—and how you’ll cover your care. In this post, we’re exploring how you can finance this important step in your journey—and live comfortably and affordably throughout your later years.

1 min read

Breathe New Life Into Your Bottom Line with Supplemental Health Products

By NAIFA on 5/17/23 10:24 AM

Accident, critical illness, and hospital indemnity products are often not top-of-mind but offer incredible value as stand-alone products, while also working well together when paired with health insurance.

At the next Advisor Today on Wednesday, May 31 at 12 pm eastern, find out how these products can provide a whole health solution for your clients and offer advantages to agents looking to grow their business.

10 min read

How to Use a Trust to Plan for Long-Term Care

By Cameron Huddleston on 5/9/23 2:30 PM

There’s a good chance that you will need long-term care as you age. After all, more than half of adults 65 and older need this sort of care when a medical issue leaves them unable to care for themselves, according to the Department of Health and Human Services. That’s why it’s important to plan for this possibility, especially considering that professional long-term care at home or in a facility can be incredibly expensive.

One way to plan financially for long-term care is to create a trust. And, no, a trust isn’t just something the wealthy use to pass on their money from generation to generation. It can be an incredibly useful tool to protect your assets if you become incapacitated and to shield your assets to qualify for certain long-term care benefits.

2 min read

What’s the Option When Long-Term Care Isn’t an Option?

By Jamie Sarno on 5/3/23 9:45 AM

This article is a continuation of Jamie Sarno's series on Short-Term Care Insurance. You can read the first part of the series here and the second part of the series here.

After posting the last two articles and hosting the short-term care webinar here at NAIFA, I have been inundated with emails and phone calls — all asking for more information on short-term care.

What I heard, from the majority of you, is that you need and want a solution when long-term care coverage is not possible for your clients — due to their age, health, or finances.

6 min read

Long-Term Care Insurance: When to Buy It & More

By Coventry on 4/20/23 9:52 AM

For many seniors, long-term care (LTC) insurance—an insurance policy that helps pay for chronic medical care—can be a worthwhile choice. After all, nearly 70% of seniors aged 65 or older will require some form of long-term care in their lifetime—a service that can be prohibitively expensive, setting families back thousands of dollars a month.

But is long-term care insurance worth it? This policy tends to come at a steep price: in the U.S., for example, the average 55-year-old man pays an annual premium of $2,220. And thanks to insurance marketing tactics, potential buyers often believe that they’ll spend years in a nursing facility—which isn’t always the case.

5 min read

Tax Breaks to Help Offset the Cost of Caring for Parents

By Cameron Huddleston on 3/24/23 10:50 AM

Caring for a parent can take a big toll on your finances. Nearly eight in 10 caregivers report having to cover expenses related to caregiving out of their own pockets and spend an average of $7,242 a year on those expenses, according to a study by AARP.

Fortunately, there are tax breaks that might help offset the cost of elder care. Find out if you are eligible for any of these federal tax credits or deductions for taking care of elderly parents.

2 min read

Change the Conversation with Financial Longevity Wellness

By NAIFA on 3/15/23 3:57 PM

Want to differentiate yourself? Then change the conversation! A hot topic that every client is concerned about is Financial Longevity Wellness. Today’s clients are worried about outliving or outspending their money or getting caught in an expensive ‘sandwich generation’ situation, or worrying about family or business financial wellness.

Join the next Advisor Today webinar on Wednesday, March 29 at 12 pm eastern, as Carroll Golden, Long-Term Care Expert and Executive Director of NAIFA's Centers of Excellence, demonstrates a three-step formula to show how to incorporate Financial Longevity Wellness in the products and services you provide, while staying focused on your client’s story.

2 min read

Long and Short-Term Care Insurance: More in Common Than You Think

By Jamie Sarno on 3/10/23 2:40 PM

This article is a continuation of Jamie Sarno's series on Short-Term Care Insurance. You can read the first part of the series here.

Did you know insurance plans that cover Nursing Home, Assisted Living, or Home

Nursing Care for a minimum of 365 days or more is considered Long-Term Care Insurance? Insurance plans that cover “less” than 365 days are considered Short-Term Care Insurance. Other than its shorter duration period, STCI shares many of the same great benefits and features that you would find in LTCI.

2 min read

Highlights from Our Limited & Extended Care Planning Center Sponsors

By NAIFA on 2/23/23 10:00 AM

As part of February's I Love NAIFA Month, we are highlighting all the aspects of the association we love. We are thankful for the support of our Limited & Extended Care Planning Center partners, who give insight, advice, and thought leadership for the long-term care space.

Don't miss some of the recent content highlights from our LECP partners to help catch up on the latest trends, programs, and options in limited and extended care.

2 min read

Join NAIFA at the ILTCI Conference in Denver, March 12-15

By NAIFA on 2/21/23 1:35 PM

NAIFA will join our Limited & Extended Care Planning Center (LECP) partner, ILTCI, for the 2023 ILTCI Conference in Denver, CO, from March 12-15, 2023, at the Sheraton Downtown Denver.

ILTCI’s annual educational conference is for representatives of the long-term and extended care planning community and other strategic allies, including providers, public policy institutions, professional organizations, federal, state, and local government agencies, and the public.

3 min read

Bridging the Gap: A Discussion of Short-Term and Long-Term Care

By Jamie Sarno on 2/10/23 3:05 PM

What if I told you…

“7 out of 10 people age 65 and over will need long-term care services and support at some point in their lives."

Nothing new, right?

For those of us in the long-term care industry, we know this statistic all too well. But I promise you, many people still do not understand what it actually means.

1 min read

Upcoming Webinar: An Alternative to Long-Term Care Coverage

By NAIFA on 1/25/23 11:48 AM

When long-term care insurance is not an option due to a person's health and/or finances, there may be an alternative solution to a difficult situation. Limited long-term care insurance can be an option to help during your client's time of need.

Register now for this upcoming webinar discussing limited long-term care on Tuesday, February 7 at 2 pm eastern.

1 min read

Buying or Selling an Agency – A Focus on Medicare

By NAIFA on 1/18/23 10:30 AM

Join Dan Mangus, VP of Growth and Development at Senior Marketing Specialists, for an Advisor Today webinar on Wednesday, January 25 at 12 pm eastern. In "Buying or Selling an Agency - A Focus on Medicare," Dan will guide you through the ins and outs of buying or selling an agency, and the top things you need to know when it comes to Medicare.

6 min read

What is a Life Expectancy Set-Aside for a Reverse Mortgage Loan?

By Harlan Accola on 1/5/23 11:16 AM

Today’s reverse mortgage loans have built-in protections designed to make sure the loan is a sustainable solution for the borrower. In this article, we’ll explore what a life expectancy set-aside (LESA) is, how it helps a borrower to pay property charges, when the lender’s underwriter will require it, and why, in some situations, it may be advantageous for a reverse mortgage borrower to voluntarily opt for a LESA.

5 min read

Paying for Long-Term Care: Know Your Options

By Coventry on 12/22/22 10:32 AM

The decision to move yourself or a loved one into long-term care can be a difficult one, and determining how to pay for long-term care can add unnecessary stress to a phase of life that’s already full of transitions. Understanding the costs you may encounter and developing a proactive plan to afford long-term care can help ease the burdens that accompany it.

3 min read

Take on the Worksite Market and Change the Way Employers Think About LTCi

By Cindy Harris on 12/19/22 12:18 PM

What do you get when modernized Long Term Care Insurance products meet changing workplace needs and employee attitudes? An advantageous opportunity to grow your business, reach the middle market, and help protect more families from potential LTC needs.

Worksite benefits have long been a critical tool in helping employers attract top talent. What’s changed is that more employers want a variety of products to build benefit packages that are as diverse as today’s workforce – and there’s room for LTCi in this conversation.

Sure, you’ll face some challenges from decision-makers, but clearing hurdles is nothing new for seasoned LTC professionals. Here are three common objections that you can address with employers to change the way they think about LTCi.

5 min read

How to Talk to Your Parents About Long-Term Care

By Cameron Huddleston on 12/9/22 9:30 AM

As your parents age, there’s a good chance they will need long-term care. According to the Department of Health and Human Services, more than half of Americans turning 65 today will develop a disability serious enough that they will need daily help with the basic activities of living. Most will need care for less than two years, but 1 in 7 will need assistance for more than five years.

As tough as it might be to imagine your parents being unable to care for themselves, the thought of discussing this possibility with them probably seems even harder. But it’s important to talk to your parents sooner rather than later to develop a plan for long-term care if they ever need it. If you wait for an emergency to strike, emotions will be running high and you’ll likely have fewer options to deal with your parents’ need for care.

2 min read

State Senate Hearing on LTC Features Testimony of NAIFA-WA's Chris Bor

By NAIFA on 12/8/22 6:01 PM

Chris Bor, LUTCF, CLU, ChFC, a loyal NAIFA member since 1998 and Immediate Past President of NAIFA-WA, testified at a hearing of the Washington State Senate Business, Financial Services & Trade Committee on the use of life insurance, annuities, and policy riders in long-term care planning. He gave an overview of a wide variety of LTC planning options and discussed the value of agents and advisors to consumers. Bor also serves as Vice-Chair of NAIFA's National Membership Committee.

1 min read

LECP's Impact Day 2022 Now Available On-Demand

By NAIFA on 11/11/22 11:55 AM

NAIFA's Limited & Extended Care Planning Center hosted "Don't Be Scared of Long-Term Care," on Monday, October 31 to help kick off Long-Term Care Awareness Month. If you missed any of the sessions that day, or want to revisit particular talks, recordings of all eight presentations are now available to watch on-demand.

1 min read

Long-Term Care Crisis ‘Sneaking Up on Most Americans’

By NAIFA on 11/3/22 9:54 AM

On Monday, October 31's "Don't Be Scared of Long-Term Care," NAIFA's Executive Director of Centers of Excellence, Carroll Golden, addressed the crisis of long-term care that is sneaking up on most Americans. "When we look at the cost of care, it’s only increasing and it’s increasing dramatically," she said at the Limited & Extended Care Planning Center's annual Impact Day.

1 min read

Tackle the Scariest Topics in Long-Term Care at LTC Impact Day 2022

By NAIFA on 10/19/22 11:32 AM

We're kicking off November's Long-Term Care Awareness Month on Halloween, Monday, October 31 to get the message out that you don't need to be scared of long-term care conversations!

NAIFA's Limited & Extended Care Planning (LECP) Center is hosting "Don't Be Scared of Long-Term Care," a free, day-long virtual program from 9 am to 5 pm. Included are interactive sessions from industry leaders who will address the scariest of topics in the long-term care arena.

2 min read

These Two Trends Signal Much Higher LTC Costs in the Future - Regardless of Inflation

By Tom Riekse Jr. on 8/24/22 3:19 PM

1 min read

Experts at Apex will Explore Technology’s Transformation of the LECP Marketplace

By NAIFA on 8/8/22 9:15 AM

The limited and extended care planning (LECP) marketplace is transforming apace with innovations in technology. The rise of 5G, the fifth-generation standard for broadband cellular networks, has revolutionized the way we handle LECP data, providing greater data speeds, more reliability, and massive network capacity.

3 min read

NAIFA's Limited & Extended Care Planning Center Top Reads from Q2 2022

By NAIFA on 7/26/22 3:15 PM

NAIFA's Limited & Extended Care Planning Center is focused on bringing you comprehensive information to help your business thrive in the long-term care sector. Below are the most read and most relevant articles by professionals like you from this last quarter (April to June 2022), written by NAIFA and our dedicated partners.

Want to see more of this content, or have a suggestion of topics you would like to see discussed? Let us know at lecp@naifa.org.

Annuities and LTC Insurance: Two Case Studies in Planning

By NAIFA

Annuities can be an important part of long-term care planning, Tom Riekse, ChFC, CLU, CEBS, Managing Director at LTCi Partners, told attendees of NAIFA’s Limited and Extended Care Planning Center webinar. “Unfortunately, there has probably not been as much emphasis on how they can work together in a plan for care as there should be based on some of the great benefits available.”

1 min read

LIMRA Finds Employers Look to Modify Employee Benefits Offerings

By NAIFA on 7/14/22 8:55 AM

A new survey by NAIFA’s industry partner LIMRA and EY found that about 75% of employers believe they will need to modify their employee benefits packages within the next five years to attract and retain top talent. Among the top benefits employers believe workers will be most interested in are: life insurance, paid family and medical leave, short-term disability, long-term disability, and physical wellness programs. The survey also found that a significant portion of workers place a greater value on workplace insurance benefits – particularly health insurance, life insurance, and disability insurance – than they did prior to the COVID-19 pandemic.

4 min read

How to Use Trusted Contacts to Gain New Clients

By Cameron Huddleston on 7/8/22 4:59 PM

Do you ask your clients for trusted contacts?

Since 2018, brokerage firms have been required by FINRA Rule 4512 to ask their retail customers to provide the name and contact information of a trusted contact person. Although the rule applies only to broker-dealers, it’s still a best practice for all wealth management and financial advisory firms to gather this information from clients.

Unfortunately, time-strapped advisors too often treat getting trusted contacts as an administrative task versus an opportunity to grow their practice. Trusted contact record-keeping should be thought of as a critical practice infrastructure, contributing far more than a list of emergency numbers. If you’re not already asking clients for trusted contacts, here are two key reasons why you should.

Reason 1: Protect aging clients from fraud and exploitation

As an advisor, you help clients build sound financial plans. However, all of that planning can be for nothing if your clients lose their money to elder financial exploitation. Millions of older Americans become victims of scams or financial abuse each year and lose more than $3 billion annually to these crimes, according to the FBI.

The aim of FINRA Rule 4512 is to protect investors—particularly seniors—from fraud and exploitation. Firms can reach out to their customers’ trusted contacts if they are concerned about activity in customers’ accounts.

Advisors are the first line of defense for older adult clients. By creating your own trusted contacts policy, you can get authorization from clients to reach out to someone they trust if you suspect your clients’ assets are at risk of exploitation. A trusted contact can help you confirm suspicions that a client’s financial decision-making ability has been impacted by cognitive decline issues or that a client is being taken advantage of by scammers or even family members. In short, it’s the right thing to do to provide your clients with the protection they deserve.

How Not To Tear Your Family Apart: Things That Bring Joy

By Carroll Golden on 6/17/22 9:30 AM

Life can be unpredictable and challenges will arise. We cannot always control our circumstances, but we can control our perspective and what we focus on. Choosing to see the good in bad or hard situations is what will make the ultimate difference in the long run. The CPT (Care Planning Team), is an important resource regarding this. They help individuals get back on track in their lives and continue that joy perspective.

How Not To Tear Your Family Apart: What Can You Grow?

By Carroll Golden on 6/16/22 9:30 AM

Long-term growth requires long-term planning. Reduction in taxes, fewer fees, more savings, and exponential growth, are all factors of long-term planning. A long-term care funding plan was also created which increases success in these areas and is an option for those wanting to be smarter with their finances.

How Not To Tear Your Family Apart: Cash Flow Concerns

By Carroll Golden on 6/14/22 9:30 AM

Proper preparation = better cash flow. Without thorough forethought and intention put into place for the future, cash flow is bound to be a concern. This excerpt dives into the specifics of what a lack of preparation results in and the cash flow measures that should be taken to prevent them.

How Not To Tear Your Family Apart: Caregiving Impacts Retirement

By Carroll Golden on 6/13/22 9:30 AM

One of the most overlooked threats to retirement is when people need to either limit their earning potential in the workforce due to caregiving demands (think not taking a promotion or limiting the ability to travel), or they leave the labor force altogether because the demands of caregiving are so great. This excerpt explores the impact that leaving/diminished workforce engagement has on future retirement planning.

8 min read

How a Reverse Mortgage Loan Can Enhance a Sound Retirement Strategy

By Fairway Independent Mortgage Corp. on 5/27/22 1:30 PM

These days, people are living longer which, of course, is a good thing. But it also means retirees’ savings must stretch further to last throughout retirement. Throw in the recent surge in inflation, rising long-term care costs, and the unfortunate reality that many retirees are not financially prepared for retirement, and we have the makings of a retirement crisis ahead.

On the bright side for older-adult homeowners, housing wealth has been on the rise. According to the National Reverse Mortgage Lenders Association (NRMLA), U.S. homeowners aged 62+ saw their home equity soar to a record $10 trillion in 2021. It can be prudent for homeowners and their advisors to discuss ways to incorporate housing wealth into retirement planning decisions.

1 min read

Loyal NAIFA Member Cheryl Canzanella Joins Fairway Independent Mortgage

By NAIFA on 5/26/22 10:28 AM

We're pleased to congratulate loyal NAIFA member Cheryl Canzanella, CLU, ChSNC, LUTCF, on her new position with NAIFA partner Fairway Independent Mortgage. Cheryl will take over the role of HECM Business Development Manager - Retirement Solutions.

Since joining NAIFA in 2010, Cheryl has been active in the NAIFA community. She is a Past President of NAIFA-Northeast Florida and has served in leadership positions at the local, state, and national levels. She is also a recipient of NAIFA-FL's President’s award. In 2019, she was recognized as NAIFA’s Young Advisor Team Leader of the Year. Cheryl is also a Founding Past President of Women in Insurance & Financial Services (WIFS) Northeast Florida.

How Not To Tear Your Family Apart: 20 Years from Now

By Carroll Golden on 5/3/22 1:37 PM

"A lack of planning has immediate consequences and possibly consequences that will reach 20 years into the future," says Golden in her new book, "How Not to Tear Your Family Apart". Golden has been bringing the concept to both financial advisors and consumers that we need to get the conversation started far sooner than anyone expects so that dire consequences do not occur that possibly impacts generations to come.

1 min read

Webinar On-Demand: IUL Sales Ideas and Long-Term Care

By NAIFA on 4/8/22 12:42 PM

Increased awareness of long-term care (LTC) insurance means increased interest in LTC coverage. However, not all clients qualify for a traditional LTC rider.

4 min read

How to Protect Aging Clients from Financial Exploitation

By Cameron Huddleston, Carefull Family Finance Expert on 3/31/22 10:00 AM

Financial exploitation of older adults is rampant, and the problem will only get worse as America’s population continues to age.

In fact, the rate at which adults over the age of 60 can expect to experience financial exploitation—1 in 20—is higher than the incidence of many age-related diseases, according to research published in The Journals of Gerontology. And that’s likely an underestimate because many older adults are unwilling to report exploitation.

1 min read

Webinar On-Demand: LTC Pricing in Uncertain Times

By NAIFA on 3/30/22 10:27 AM

Rising interest rates and inflation can dramatically impact long-term care insurance pricing.

This month, LTCI Partners Managing Director Tom Riekse spoke with Robert Eaton, Principal and Consulting Actuary of Milliman. In addition to interest rates and inflation, Riekse and Eaton discussed recent innovations in LTC product design and how to build trust in the digital age.

2 min read

Sen. Scott Promotes Care Planning and LTC Insurance in Committee Hearing

By NAIFA on 3/25/22 2:43 PM

Senator Tim Scott (R-SC) knows the importance of the insurance and financial services industry and the role of agents and advisors in the wellbeing of Main Street Americans. He gained much of this understanding in his pre-political career as an insurance professional and NAIFA member.

5 min read

Why Your Clients Should Plan for Long-term Care Sooner Rather than Later

By Fairway Independent Mortgage Corp. on 3/23/22 4:41 PM

There is and likely will always be a debate between what’s better: “optimistic” or “realistic” thinking. When it comes to retirement and aging, it’s beneficial to have both mindsets. To look forward to the enjoyment of the golden years while recognizing the need to plan ahead for rainy days.

8 min read

Advantages of Reverse Mortgage Loans over HELOC and Home Equity Loans

By Fairway Independent Mortgage Corp. on 3/17/22 11:39 AM

For your clients who are homeowners aged 62+, a Home Equity Conversion Mortgage (HECM, commonly called a reverse mortgage) loan offers some distinct advantages over other types of home-equity-release loans.

According to a survey conducted by Clever,* about half (51 percent) of retirees believe they will outlive their savings. Perhaps even more worrisome, the study also found that 65 percent of retirees say they are not financially secure. They may be facing any number of financial challenges, including how to best pay for long-term care or combat recent jumps in the prices of food, gas, and just about everything else.

As a financial professional, you want to give your clients the best chance at financial success. For most homeowners aged 62 and older, home equity represents the largest portion of their overall net wealth, usually dwarfing their other assets (e.g., retirement savings). While home equity is good, unless the home is sold or the equity is tapped, it is of essentially no functional value to a homeowner in retirement because it is generally very illiquid.

1 min read

Loyal NAIFA Member Louis Brownstone Featured in Broker World

By NAIFA on 3/15/22 1:28 PM

Loyal NAIFA-CA member Louis H. Brownstone, CLTC, proposes a new solution for long-term care insurance planning in a recent Broker World article. Brownstone is the owner of California Long Term Care Insurance. A NAIFA member since 2007, he is the Government Relations/APIC IFAPAC Chair for NAIFA-San Francisco Peninsula and a NAIFA Financial Security Advocate.

Congratulations, Louis. We're #NAIFAproud of your commitment and dedication to our industry.

3 min read

NAIFA Thought Leaders to Be Well Represented at ILTCI 2022

By NAIFA on 3/15/22 9:23 AM

The Intercompany Long-Term Care Insurance Conference (ILTCI 2022) is taking place March 21-23 in Raleigh, NC, with sessions featuring NAIFA thought leaders and a special NAIFA networking event. The ILTCI’s annual educational conference is for representatives of the long-term and extended care insurance community and other strategic allies, including providers, public policy institutions, professional organizations, federal, state, and local government agencies, and the public. Online registration for the event is open.

2 min read

Top 5 Considerations as You Evaluate New Whole Life Products

By OneAmerica on 3/8/22 10:13 AM

Along with resolutions and high hopes, the new year also brings many insurance carriers promoting changes to their whole life insurance product portfolios. These revisions are due to adaptations in the IRC Section 7702 regulations. Prolonged low interest rates also continue to factor into product refreshes, revamps and adjustments. It may be overwhelming to sift through the fine print of the new products, but as you begin to evaluate them, keep these top five considerations in mind:

8 min read

Inflation Presents Unique Challenges for Retirees

By Fairway Independent Mortgage Corp. on 3/1/22 11:34 AM

Home Wealth Can Help Your Older-Adult Clients to Fight Inflation.

These days, inflation is on the minds of most people — and it is of particular concern for seniors. With prices rising at the fastest pace in decades, many people who are in or nearing retirement have heightened fears they may outlive their savings.

The stage is set for home wealth, which has also been on the rise, to play an important role in helping retiree homeowners to support a more efficient retirement income strategy. As a financial professional, you want to give your clients the best chance at financial success, which is why it is imperative that the strategic use of home equity is part of any retirement-planning conversation.

3 min read

The Limited and Extended Care Planning Center Sounds Off!

By Carroll Golden on 2/25/22 5:18 PM

It has been critical for the Extended and Long-Term Care (LTC) Industry to weigh in on the publicly funded LTC program in Washington State (WA Cares). The industry has historically welcomed a public-private LTC option. And we are hopeful that the various state legislatures considering similar programs will embrace knowledgeable suggestions from industry insurers, business processing firms, distributors, agents, and advisors. In addition, there are proposals at the federal level that also could benefit from industry participation.

8 min read

Home Equity Conversion Mortgage (HECM) Loan: What You Need to Know

By Fairway Independent Mortgage Corp. on 2/16/22 12:51 PM

While there are several different types of reverse mortgages, most reverse mortgage loans today are HECMs—the only reverse mortgages insured by the Federal Housing Administration (FHA).

Many financial professionals now consider today’s HECMs to be an important and effective tool (when used within a comprehensive financial plan) to help improve retirement outcomes for their older-adult homeowner clients.

1 min read

Gandy Inspires Advisors to Have Their Best Year Ever

By NAIFA on 2/10/22 9:28 AM

NAIFA Trustee Christopher Gandy, LACP, was featured presenter at the NAIFA-NC chapter’s February virtual meeting. After presiding over the installation of NAIFA-NC’s 2022 Board of Directors, Gandy gave his presentation, “Your Best Year Ever.”

Drawing on his experiences as a professional basketball player and a highly successful financial professional, Gandy challenged agents and advisors to reach their highest levels of achievement. “You cannot do ordinary things and expect extraordinary results,” he said. “You have to do ‘the extra.’”

1 min read

Upcoming Webinar: Tech Tools to Grow Your Long-Term Care Practice

By NAIFA on 2/3/22 12:02 PM

Whether you're a long-term care veteran or interested in expanding your practice, this webinar is for you!

3 min read

Meet Loyal NAIFA Member Angie Hughes

By Ronan Friend on 1/12/22 10:00 AM

Angie Hughes, LTCP, is a 22-year insurance veteran and long-term care insurance expert with Producers XL in Salina, Kansas.

Hughes began her insurance career selling property and casualty insurance, but found her true calling in educating agents, advisors, and consumers about long-term care (LTC) planning. “No day is ever the same,” she says, and she thrives on sorting through the complexities of the LTC world to find solutions for her clients.

1 min read

Fairway Presents Webinar on Home Equity and Roth Conversions

By NAIFA on 1/7/22 4:55 PM

Join us on February 11, 2022, at 3 pm eastern for the special webinar "Home Equity and Roth Conversions".

The discussion will feature Harlan Accola, CRMP, National Reverse Mortgage Director of Fairway Independent Mortgage Corporation, interviewing Jim Silbernagel, CFP, CEPS, LACP, LUTCF creator and host of Real Wealth® Marketing, on how he has helped clients lower their tax burden using the equity in their homes.

2 min read

Using Technology to Deepen Client Relationships Across Generations

By Cameron Huddleston, Carefull Family Finance Expert on 1/7/22 4:28 PM

Technology might not seem like a likely tool a financial advisor can use to build client relationships. It almost goes without saying that older generations prefer human interaction versus digital services when it comes to their finances. And surveys have found that even tech-savvy millennials are more likely to get help with their finances from real-life advisors than from robo-advisors.

So how can technology help financial advisors strengthen and add value to their relationships with clients—especially older clients—when it lacks the human touch? After all, a computer can’t hold your hand during a market downturn.

But there is new technology that can enable advisors to build their businesses by giving them the ability to better assist aging clients and clients taking care of aging parents at the stage of their financial lives where they need the most help. That new technology is Carefull.

5 min read

Why You Need to Talk to Clients About Monitoring

By Cameron Huddleston, Carefull Family Finance Expert on 12/29/21 8:00 AM

Courtney Heiden’s dad always took care of the family finances. In fact, he had a background in finance and managed client accounts at the large companies where he worked. So it came as a complete shock when there was a knock on her parents’ door several years ago, and the man at the door said the house was going to be auctioned off the next day.

“My mom actually thought they were kidding or maybe had the wrong house,” Heiden said. “And the man at the door said, ‘No, there's not been a mortgage paid in nine months.’ Their world kind of came crashing down at that moment.”

10 min read

What You Should Know About Reverse Mortgage Interest Rates

By Fairway Independent Mortgage Corp. on 12/22/21 9:00 AM

It’s easy to lose focus on interest rates when you’re helping your client search for a reverse mortgage loan.

After all, the interest rate won’t affect the monthly payment because they won’t have to make one (though they will need to pay taxes and insurance and maintain the home).

Reverse loans don’t require monthly payments, as the full balance comes due when the last borrower dies or leaves the home.

But reverse mortgage interest rates are still a big deal and should factor into your clients' borrowing decisions. The interest rate will make a huge difference when the balance comes due and your client or their heirs must decide what to do with the home.

1 min read

Carefull Presents Webinar on Tech Tools and Long-term Care

By NAIFA on 12/14/21 8:00 AM

Join us on January 11, 2022, at 1 pm eastern for "Financial Technology that Builds Long-Term Relationships for Long-Term Care", a special webinar presented by Carefull co-founder Todd Rovak and product strategy lead Michael Rubel.

Rovak and Rubel will discuss the challenge of client engagement and how Carefull's technology can help overcome it. The webinar will also feature a Q&A with NAIFA-National President-Elect Bryon Holz speaking on his own experience with long-term care insurance and how it has affected his family.

1 min read

NAIFA and LifeSecure Announce Educational Partnership

By NAIFA on 12/6/21 4:00 PM

NAIFA and LifeSecure have completed an educational partnership agreement to advance thought leadership and consumer education and promote professional cooperation between the two organizations. Under the partnership, LifeSecure will provide content for NAIFA blog posts and social media platforms, as well as articles for NAIFA’s Advisor Today.

1 min read

Guaranteed Income: The Forgotten Household Asset

By Mutual of Omaha Mortgage on 12/1/21 12:15 PM

Guaranteed income is the largest financial asset for most retirees, yet its role in a financial plan is generally quite minor, treated simply as a cash flow that can be used to fund the retirement liability.

2 min read

2021 LECP Impact Week On-Demand

By NAIFA on 11/10/21 8:30 AM

To kick off Long Term Awareness Month, the Limited and Extended Care Planning Center held the 2021 Impact Week, November 1st - 5th.

Each day featured industry experts discussing a broad range of topics and emerging issues. All the presentations are now available on-demand.

1 min read

NAIFA's Diane Boyle to Provide Policy Update For NAIFA's LECP Impact Week

By NAIFA on 11/1/21 4:04 PM

Decisions made by policymakers from Washington, D.C., to Washington state are impacting the way insurance and financial professionals are helping consumers plan for their long-term care needs. NAIFA's advocacy team, working with the Limited and Extended Care Planning Center's Legislative Working Group, which consists of LECP sponsors, insurers, NAIFA members, third-party administrators, distributors, and other stakeholders, is exploring and enhancing policy positions for NAIFA through the association’s government relations capabilities as it engages directly with lawmakers and regulators. NAIFA is the only association of insurance and financial professionals making an advocacy impact at the federal, interstate, and state levels, including in every state capital around the country.

1 min read

Play “The CLTC Game of Longevity” during LTC Awareness Month

By CLTC on 10/28/21 5:33 PM

Do you have the competency, confidence, and credibility to help your clients successfully plan for one of the greatest risks that come from living a long life – namely, the need for extended care?

1 min read

Leaders in Long Term Care Technology Present at Impact Week

By LECP Center on 10/28/21 9:00 AM

NAIFA LECP Impact Week will feature industry leaders for a panel discussion on "Technology Shark Tank: Taking the Robot out of the Advisor/Agent.”

The panel will address how to use the right technology to increase your profit, outreach, and professionalism. Ken Leibow, Founder and CEO of InsurTech Express, will moderate the discussion.

The panelists will be LECP Impact Week sponsors:

- Charles Pedneault, Vice President of Insurance Distribution Solutions at Equisoft

- Ian Ryan, Brokerage Director at BackNine Insurance and Financial Services

- Todd Rovak, Co-Founder of Carefull

- Max Posner, Customer Success Manager at Proformex

Join us virtually on November 4, 2021 from 12 - 1 pm eastern.

NAIFA thanks our LECP Impact Week sponsors Equisoft, BackNine Insurance and Financial Services, Carefull, and Proformex.

1 min read

OneAmerica Presents at LECP Impact Week

By David Lahoud on 10/27/21 4:30 PM

OneAmerica will have two panelists for the NAIFA 2021 Long Term Care Impact Week event starting on November 1st - November 5th. Jeff Levin and Michelle Prather are both loyal NAIFA members and their expertise will provide valuable insights for the event.

On November 3rd, Levin, the Divisional Vice President, Care Solutions. will join the Executive Leadership Roundtable to discuss the challenges and other issues industry leaders address with LTC.

1 min read

Carefull Co-Founder Todd Rovak Will Speak at LECP Impact Week

By LECP Center on 10/27/21 12:06 PM

Todd Rovak, co-founder of Carefull, will be a featured panelist at this year’s Limited and Extended Care Planning Center Impact Week. Founded in 2020, Carefull is a platform that provides resources for financial caregiving, helping aging loved ones manage their day-to-day finances.

Rovak will participate in the panel, "Technology Shark Tank: Taking the Robot out of the Advisor/Agent," which will address how to use technology to increase productivity, profitability, and personal connection with clients. Rovak will be joined by representatives from the technology companies: Equisoft, BackNine Insurance, and Proformex. The panel will be moderated by Ken Leibow of InsureTech Express.

The panel will take place Thursday, November 4th, from 12 - 1 pm eastern.

Each day of the LECP Impact Week will feature thought leaders and industry experts in long-term care.

Carefull is a NAIFA partner and supports the Limited and Extended Care Planning Center and financialsecurity.org. Members can learn more about Carefull and how to partner within the Member Portal.

3 min read

Success Is a Collaboration of Problems Solved at NAIFA's LECP Impact Week

By NAIFA on 10/25/21 4:01 PM

NAIFA’s Limited and Extended Care Planning Center is hosting the second annual NAIFA LECP Impact Week, November 1st - 5th.

The virtual event, with the theme Success Is a Collaboration of Problems Solved, has been revamped for 2021. Each of the five days of Impact Week programming will drill down on a specific topic and feature multiple presenters in a packed one-hour presentation, 12 - 1 pm eastern.

Earn Free CE at Special Webinar: The Newest Trends in Life Settlement

By NAIFA on 10/19/21 2:02 PM

As American seniors find that their old life insurance policies may no longer suit their needs, there has been increased interest in life settlements.

Join Peter Hershon, CLU, ChFC, Senior Vice President of Account Services at Coventry, for a one-hour, free continuing education webinar to discuss rising demand and strategies to best serve clients.

The webinar will take place on Wednesday, October 20, 2021, at 1 pm eastern.

1 min read

E4 Insurance Presents a Special BREW Featuring Shane Van Patten

By NAIFA on 10/11/21 3:31 PM

E4 Insurance Services invites you to join our Building Relationships Every Week (BREW) Wednesday, Nov. 3, 2021, from 12:00-12:30 PM CST. November is Long-Term Care Awareness Month, and we want to help you start your month with all the tools you need!

Shane Van Patten, CLTC, E4 Insurance Services Regional Vice President has been helping Financial Professionals proactively integrate insurance into their practices for the past 16+ years.

1 min read

NAIFA and Carefull Announce Educational Partnership

By NAIFA on 10/7/21 3:40 PM

The National Association of Insurance and Financial Advisors (NAIFA) and Carefull have completed an educational partnership agreement to advance thought leadership and consumer education and promote professional cooperation between the two organizations. Under the partnership, Carefull will provide preferred access to the Carefull monitoring technology for NAIFA members, content for NAIFA blog posts and social media platforms, as well as articles around protecting and managing older adult's finances for NAIFA’s Advisor Today.

2 min read

The Limited and Extended Care Planning Center Sounds Off!

By Carroll Golden on 10/1/21 3:45 PM

It would be an understatement to say that it is critical for the extended and long-term care (LTC) industry to weigh in on the Washington State legislation that creates a publicly funded LTC program. The industry has historically welcomed a public-private option and we are hopeful that the various state legislatures contemplating instituting publicly funded programs of their own will embrace knowledgeable suggestions from insurers, business processing firms, distributors, agents, and advisors. At the federal level, there are proposals that would also benefit from industry participation.

4 min read

Retirement Regrets – Does Retirement Live Up to Expectations?

By Coventry on 9/27/21 8:30 AM

Ah, retirement. The reward at the end of years in the labor force, of saving and investing and planning for financially sound, restful, and even adventure-filled golden years. Millions of Americans enter retirement annually, but increased reliance on Social Security income and Covid-19’s impact on employment, access to social supports, and mental and physical health have altered the retirement experience for retirees across the U.S. With retiree numbers significantly increasing in the last year and predictions of more to come at an accelerated rate, we wanted to know if retirement still lives up to expectations. Are retirees experiencing the retirement they expected, or do they have regrets?

1 min read

Caroll Golden Discusses the Washington Cares Act and LTC on Podcast

By Beth Helberg on 9/10/21 12:00 PM

On August 31st, NAIFA’s LECP Executive Director Carroll Golden, was on the Producers XL broadcast: The Long-Term, Angie's Advice for Agents with NAIFA member Angie Hughes.

3 min read

The Importance of Long-Term Care Planning From an ER Doctor’s Perspective

By NAIFA on 9/3/21 1:15 PM

As an emergency medicine physician for 20 years, including the past 12 years working in a large, level 1 trauma center, Dr. Monica Williams has seen innumerable patients and families facing long-term care challenges. As the Medical Director for Advance Care Planning and End of Life Education for the third-largest community-owned hospital system in the United States, she has spent a portion of her career talking to doctors about how they can have effective advanced medical planning and end-of-life conversations with patients and families.

1 min read

Carroll Golden Talks Washington Care Act

By Jaquetta Gooden on 8/25/21 8:30 AM

NAIFA’s LECP Executive Director Carroll Golden joins Angie Hughes on the Producers XL broadcast: The Long-Term, Angie's Advice for Agents on August 31st, at 11 am eastern to discuss the Washington Care Act.

1 min read

LECP Webinar presented by Coventry: What's Driving Life Settlement Growth

By Beth Helberg on 8/18/21 10:26 AM

Join the LECP at 2 pm eastern on Thursday, September 23rd, for a virtual executive roundtable - What's Driving Life Settlement Growth. The discussion will focus on current market trends in life settlements and how you can leverage this important tool.

1 min read

Special Webinar: The Psychology of Retirement (1 CFP credit)

By NAIFA on 8/9/21 4:40 PM

NAIFA's Limited & Extended Care Planning Center partner, Mutual of Omaha Mortgage, will be hosting an exclusive webinar on Thursday, August 19th at 2 pm eastern. Join Robert Laura, AAMS, CPRC for "The Psychology of Retirement." Explore the psychology of retirement and how to win at retirement by developing a new mindset. This program has been approved for 1.0 hour of CFP credit.*

6 min read

How to Protect Your LTC Plan From Future Inflation

By Tom Riekse Jr. on 7/21/21 11:02 AM

Significant inflation - something that the majority of Americans have not seen in their lifetime - has been a primary news topic. From concerns about exploding national debt and high government spending levels to an expanding post-pandemic economy, many people are concerned about sustained inflation and decreased purchasing power. Or, as many economists are assuring us, this could be a short-term event as the economy bounces back from the pandemic. Nobody knows!

1 min read

A CLTC Teachable Moment... Who Provides Extended Care Where?

By CLTC on 7/7/21 7:00 AM

Most clients say they want to receive care in their homes. But they also say they don’t want to be a burden on family or friends.

Both goals are understandable and maybe in conflict when care is needed. As with so many things in life, it can be wise to be careful of what we wish for.

1 min read

OneAmerica’s Tim Vannoy Presents on Hybrid Annuities and Long-Term Care Provisions

By NAIFA on 6/30/21 5:30 PM

The June LECP webinar featured OneAmerica Sales Director, Tim Vannoy, who presented the “Hybrid Annuities and the Long-Term Care Provisions.” Using case studies, Vannoy addressed the following issues:

- Who would benefit from the Pension Protection Act?

- How large is the market for the Pension Protection Act?

- How can a client get tax-deferred gains out tax-free?

1 min read

A CLTC Teachable Moment… The Power of Starting a Conversation

By CLTC on 6/8/21 2:31 PM

Three Compelling Reasons Why Planning for Care is in Your Client's Best Interest:

- Impact on loved ones

- Lifestyle

- Financial Security

Having a plan for long-term care can help ensure that clients: don’t overburden loved ones; maintain their lifestyle, for themselves and their partner; and maintain future financial security.

1 min read

NAIFA’s Maeghan Gale Speaks to LTCI Partners on Recent Trends in LTC Legislation

By LECP Center on 6/4/21 5:33 PM

NAIFA’s Policy Director Maeghan Gale joined LTCI Partners Managing Director, Tom Riekse, and Director Steve Cain for a panel discussion about recent Long Term Care Insurance legislation. For many years, Long-Term Care Insurance took a backseat as it relates to legislative action on the state and federal level. However, 2021 has brought a wave of activity as lawmakers consider the best way to support their growing aging populations.

3 min read

The Private LTC Insurance Option for Washington State Workers

By LTCI Partners on 5/20/21 11:52 AM

Have you heard of the Washington Cares Fund? If you haven't, it's the first state run and funded Long-Term Services & Supports program. Originally signed in 2019 by Governor Jay Inslee, as of January 1st, 2025, Washington State Residents who need long-term care may be able to claim benefits (based on needing help with 3 of 10 ADLs) from the state and receive a benefit of up to $100 per day up to a maximum benefit of $36,500. Undoubtedly for many families these benefits are going to welcomed and helpful. But, of course, someone has to pay for the program.

Complimentary CE at this Exclusive Webinar Presented by Mutual of Omaha Mortgage

By Beth Helberg on 5/5/21 4:26 PM

NAIFA partner Mutual of Omaha Mortgage is offering a webinar on Tuesday, May 18th at 1:00 p.m. central, with industry expert Wade Pfau, Ph.D., CFA, RICP as he discusses how different types of annuities work.

6 min read

Why Single Pay LTC Insurance Might be the Right Strategy Now

By Tom Riekse Jr. on 4/29/21 10:30 AM

The recent stock market run (especially in tech stocks) has been amazing. Despite the high unemployment rate, many investors are enjoying that feeling of increased net worth in both their qualified and non-qualified money.

6 min read

How low interest rates are changing LTC Insurance products

By Tom Riekse Jr. on 4/22/21 1:00 PM

The last several years have seen major changes in LTC Insurance - leading to what can be referred to as LTC 2.0. LTC 2.0 means that while the pure protection of traditional LTC insurance is still a popular option, there has been an accompanying growth in Hybrid LTC + Life plans - both in number of policies sold and number of carriers offering these plans.

1 min read

CLTC Offers "A Teachable Moment"

By CLTC on 4/15/21 5:07 PM

The Certification for Long-Term Care has produced a fact sheet, "A Teachable Moment: The Power of Starting a Conversation," to help advisors start conversations with clients about the importance of extended care planning. It offers facts and statistics that emphasize the importance of planning.

6 min read

Why the Traditional LTC Market is here to stay - and will grow

By Tom Riekse Jr. on 4/14/21 3:30 PM

Recently I received an email from a Insurance Carrier who sells Linked Life/LTC plans with the headline "What happened to traditional LTC?". The email started by saying "It wasn't so long age that traditional long-term care (LTC) insurance dominated the market, but now they are barely holding on while linked-benefit products are taking over." Harsh!

5 min read

The Impact of Voluntary Interest Payments on Reverse Mortgages

By Shelley Giordano on 4/12/21 8:30 PM

In the early days of reverse mortgage lending, little attention was paid to the impact of tax deductions from accrued interest on the loan. In part, most borrowers had so little income that any deduction was meaningless. Two important changes in the reverse mortgage landscape, however, have generated a more strategic approach to the home asset.

5 min read

The biggest mistakes people make when choosing to self-insure for LTC

By Tom Riekse Jr. on 4/5/21 10:15 AM

For Financial Professionals that are savvy enough to have a discussion about the impact of a long-term care event one of the most important topics is whether a client should consider long-term care insurance or should instead "self-insure".

3 min read

New Premiums Increasing on Hybrid Life + LTCI Plans

By Tom Riekse Jr. on 3/30/21 2:00 PM

Many clients find that the best way for them to plan for LTC is by purchasing a linked life/ltc plan. Compared to traditional LTC policies which provide pure long-term care protection (and the most LTC protection per premium dollar) linked Life/LTC trade off some of that leverage to provide guaranteed premiums and a life insurance benefit.

7 min read

The worst case scenario - is lifetime LTC Insurance worth it?

By Tom Riekse Jr. on 3/26/21 9:00 AM

Luckily, you aren't going to need years and years of high cost long-term care. But what if you did?

3 min read

Prepare for the Great Wealth Transfer

By LegacyShield on 3/3/21 11:07 AM

Since the inception of the computer, it has opened doors, transformed current industries, and created new ones at breakneck speed. With each new development, such as the internet, the cellphone, and the smartphone, the pace at which our society evolves has increased exponentially. The future is now, but it is also tomorrow. However, there is an interesting divide that we can actively observe between generations.

1 min read

NAIFA-WA Urges LTC Bill Changes to Protect Employees With Private Coverage

By NAIFA on 2/12/21 2:45 PM

1 min read

Consumer Resources for LTC Insurance: Agents and the NAIC Buyer’s Guide

By NAIFA on 2/8/21 9:45 AM

Most states require financial professionals to provide consumers with a copy of the National Association of Insurance Commissioners publication “A Shopper’s Guide to Long-Term Care Insurance” before completing an LTC insurance sale.

1 min read

Oliver Wyman Survey results released focusing on Long-term care planning

By Vincent Bodnar on 2/4/21 1:38 PM

In collaboration with Ice Floe Consulting, Oliver Wyman presents the results of the Who is Selling What? To Whom How & Why? agent and advisor survey conducted this past fall.

1 min read

NAIFA Supports Replacement of Indiana LTC Insurance Program

By NAIFA on 2/4/21 11:51 AM

NAIFA is encouraging the efforts of Indiana state Sen. Greg Walker and Rep. Martin Carbaugh to replace the Indiana Long Term Care Insurance Program, also known as the RWJ Partnership, with legislation (HB 1405 and SB 261) to create a Deficit Reduction Act (DRA) Partnership.

1 min read

NAIFA Supports Maryland Bill to Boost LTC Education

By NAIFA on 2/1/21 4:33 PM

NAIFA supports Maryland state legislation that would provide consumers in the state with easier access to resources and educational materials on long-term care (LTC) planning. A NAIFA-Maryland member served on the Task Force on LTC Education and Planning that made recommendations that helped shape the bill, HB 599, Public Health – Long Term Care Planning.

3 min read

Why Insurance Agents Should Care About Collaboration

By LegacyShield on 1/28/21 1:29 PM

Policyholders are looking for more than just a policy these days. Customers want an insurance agent who acts as their trusted advisor, collaborating with them to protect their assets and help reach financial goals. In fact, 75% of policyholders would switch insurers to get more personalized service.

1 min read

Exclusive Webinar: Using Housing Wealth to Improve Financial Outcomes in Retirement

By NAIFA on 1/7/21 2:11 PM

As clients retire, and hence end the receipt of regular income from employment or professional activity, cash flow considerations become paramount. This webinar examines four situations in which home equity can be used to diminish retirees' risk of cash flow exhaustion while maintaining an acceptable level of living expenses.

6 min read

What You Should Know About Life Insurance Settlements

By Pinney Insurance on 1/7/21 10:41 AM

If you have a client who can’t afford their policy – especially if it’s due to health problems – you may want to help them look into a life settlement. Of course, this leaves them without any death benefit protection, which isn’t ideal. But if they either don’t need the coverage or have no financial option but to let it lapse, a settlement may be the ideal solution.

2 min read

The Black Swan: The Generational Impact of the “Baby Boomers” and “Longevity"

By Carroll Golden on 1/6/21 4:48 PM

Over the holidays, I had time to read a very interesting book that seems to directly relate the COVID-19 Pandemic chain of events. The Black Swan: The Impact of the Highly Improbable Event by Nassim Nicholas Taleb. Although the book discusses the black swan phenomenon in relation to investing, it seems to hit home when looking at the impact and rational that is surfacing around the COVID-19 Pandemic. The book focuses on three principal characteristics. The event is rare and unpredictable. It is an outlier so rare that even the possibility of such an event is not identified. The event produces a catastrophic impact. And finally, we create an explanation that makes it appear less random and more probable and eventually predictable. Interestingly, there are some positive Black Swans such as the impressive success of Google and Facebook. On the other hand, there is the tragic events of 9/11 which fits as a Black Swan. The COVID-19 pandemic that is taking its toll on individual families, entire generations, and the global economy also qualifies as a “Black Swan event."

2 min read

Using Medicare Publications

By Dan Mangus, Vice President of Sales, Senior Marketing Specialists on 1/6/21 2:14 PM

As an advisor to individuals on Medicare or advising a caregiver to someone on Medicare, you require accurate information. One of the best reference tools for you to share with them is Medicare publications. They are easy to access on Medicare.gov and available on a variety of topics. Here are a few that I find outstanding.

2 min read

Common Misconceptions About Long Term Care

By Genworth on 12/22/20 11:22 AM

Cover all of your bases with four common rebuttals about long term care planning.

There are plenty of misconceptions about long term care. Some believe that health insurance and Medicare will take care of these expenses. The majority of costs for long term care are out-of-pocket expenses until assets are depleted. The following are four common rebuttals you might hear about long term care planning and what you need to know:

2 min read

Life Insurance Trends 2020

By Dan Pierson on 12/16/20 3:34 PM

If these past few months have taught us anything, it’s that trend-forecasting is an inexact science. We’ve all known for at least the past two decades that technology would continue to change our world, seamlessly integrating itself into our daily lives until almost everything can be ordered, viewed, or accomplished digitally. But very few of us could have predicted just how much, and how quickly, we would have to adapt to a world where working from home, video-chatting with doctors, and ordering groceries was not only an option but a necessity. It’s changed the way we conduct business – so much so that many industries, like life and health insurance, have been forced to reevaluate their relationship with tech to meet the demand of advisors and clients alike. They’ve begun to realize that technology is not just a trend they must grudgingly dip their toes into but an opportunity to dive in head first for total transformation. Keeping all that in mind, here are the most notable trends that insurance agents should be aware of.

5 min read

An Outstanding Opportunity to Grow Your Business for Generations

By Carroll Golden on 12/15/20 6:57 PM

The sales and marketing landscape has changed. Have you?

2 min read

The ILTCI Joins as a Financial Security Alliance Partner

By NAIFA on 11/13/20 3:18 PM

Industry groups unite the insurance and financial services industry to promote financial literacy and encourage a new generation of agents and advisors.

1 min read

Meet Gerry: NAIFA Welcomes 'Gerry' as a New LECP Sponsor

By NAIFA on 11/10/20 4:04 PM

Meet Gerry, the new way to find your future care facility. Using aggregated data from every senior living facility in the country, Gerry matches clients with an assisted living community to ease them through their decision. We are excited to announce Gerry as a new sponsor of the Limited & Extended Care Planning Center (LECP) within NAIFA.

1 min read

Transamerica LTC Update & Review

By NAIFA on 11/10/20 3:58 PM

Presented by: Matt Hamann, National Sales Director, VP Institutional, Worksite Multi-Life & Brokerage at Transamerica

4 min read

NAIFA’s Limited & Extended Care Planning Center Announces its Inaugural Long Term Care Event

By NAIFA on 10/16/20 5:20 PM

The three-day event will offer a broad view of extended and long-term care topics and options. Whether you advise clients about life insurance, annuities, saving or college plans, wealth management, or retirement planning, your clients' plans and lifestyle can be impacted by complications of caregiving or a need for extended or long-term care.

Falls Church, VA (October 16, 2020) -- The National Association of Insurance and Financial Advisors (NAIFA) and NAIFA’s Limited and Extended Care Planning Center will host its first annual NAIFA LECP Center event. The virtual conference will be held on November 10-12. The inaugural event is made possible by the founding sponsors of the Limited & Extended Care Planning Center.

Three hours of programming each day will include an extensive, wide range of topics and options and explore issues important to agents and financial professionals.

Panel discussions by industry leaders will dive into:

- Executive Leadership (Dennis Martin, President, Individual Life and Financial Services at OneAmerica; Troy Anderson, Vice President and National Sales Manager, Life Insurance, at Nationwide Insurance; Bill Nash, Senior Vice President Head of MoneyGuard and Strategic Partners of the Future at Lincoln Financial Distributors; and moderator Kevin Mayeux, CEO of NAIFA).

- Hybrid Life Insurance and Annuity Products for Long-Term Care (Ryan Bivens, LTC National Sales Manager at Pacific Life; Tracey Edgar, Vice President of Sales, Care Solutions at OneAmerica; Brandon Heskett, National Sales Vice President – SecureCare at Securian Financial; Tony Massenelli, Director Long Term Care Sales at Nationwide Insurance; and moderator Steve Cain, Sales and Business Development Leader at LTCI Partners).

- Technology and Long-Term Care Planning (Sheryl Moore, President and CEO of Moore Market Intelligence; Jared Carlson, Vice President, Individual Sales & Ventures at Assurity; Steve Cain, Sales and Business Development Leader at LTCI Partners; and moderator Ryan Pinney, President at Pinney Insurance Center).

1 min read

Industry Survey on Long-Term Care Now Underway

By Suzanne Carawan on 9/14/20 1:48 PM

NAIFA has been selected as a survey partner to Oliver Wyman along with NAILBA and BrokerWorld to undertake an industry-wide research study on the state of sales of long-term care products. The survey is entitled "Long-Term Care Insurance Planning Survey: Who’s Selling What to Whom, How and Why?" and seeks to understand how the landscape has changed through COVID-19.

6 min read

Are you guilty of malpractice in your work?

By Harlan Accola on 8/31/20 4:48 PM

Here are some of the words the dictionary uses to define malpractice: improper, illegal, or negligent professional activity or treatment, especially by a medical practitioner.

10 min read

LECP Webinar: VA Benefits and Medicare – Beyond the Basics

By NAIFA on 8/31/20 2:26 PM

Presented by NAIFA’s Limited and Extended Care Planning Center

2 min read

FEDERAL LTC TASK FORCE INCLUDES NAIFA RECOMMENDATIONS IN REPORT

By NAIFA on 8/11/20 2:28 PM

The U.S. Treasury Department has released a report from the Federal Interagency Task Force on Long-Term Care Insurance recommending government actions to foster innovation in long-term care (LTC) product design, improve the efficiency and relevance of LTC product regulation and promote financial literacy on LTC matters.

3 min read

LECP Webinar: Proven Approaches and Techniques Using Traditional Long-Term Care and Hybrid Life Insurance

By NAIFA on 7/30/20 2:34 PM

Denise Gott, CLTC, is CEO of ACSIA Partners

Worksite LTCI - ARM Makes it Easy!

By ARM on 7/28/20 12:00 PM

3 min read

Webinar: Increasing Options for Extended and LTC Planning

By NAIFA on 7/9/20 9:33 AM

Featuring Carroll Golden, CLU, ChFC, CLTC, CASL, LECP, FLMI

3 min read

Annuities and LTC Insurance: Two Case Studies in Planning

By NAIFA on 6/29/20 4:00 PM

Annuities can be an important part of long-term care planning, Tom Riekse, ChFC, CLU, CEBS, Managing Director at LTCi Partners, told attendees of NAIFA’s Limited and Extended Care Planning Center webinar. “Unfortunately, there has probably not been as much emphasis on how they can work together in a plan for care as there should be based on some of the great benefits available.”

2 min read

New CLTC Class for NAIFA Members Starts in July

By Suzanne Carawan on 6/29/20 1:43 PM

The National Association of Insurance and Financial Advisors (NAIFA) and the Certification for Long Term Care (CLTC) announce a new series of preparatory classes for NAIFA members. The new virtual series and exam will allow more NAIFA members to earn their CLTC designation. The class series is the latest byproduct of the strong partnership between NAIFA and CLTC.

2 min read

Offer Appropriate Coverage for LTCi

By Romeo Raabe on 6/9/20 11:00 AM

Do your prospects ask for a specific amount of LTCi, or do they look to you for advice on how the coverage should be structured and how much they might need?

They (you) may have read the studies of how much a nursing home costs, which might be a starting point. However, the costs can vary as much as 100% between the highest and lowest cost areas of the US. Thus, the first step might be to inquire where your prospects plan to reside in their retirement.

4 min read

Why there may be a rush to buy LTC Insurance policies

By Tom Riekse Jr. on 4/23/20 2:28 PM

Years from now, those of us who lived through the Coronavirus Pandemic will think about the early rush to buy toilet paper and how odd that seemed. As of today (and things could change), there is plenty available at Costco, but they are limiting people to just one 30 pack. Just how long does a 30 pack last? Well, someone has created a Coronavirus Poop Calculator (thepooptool.com) to help people figure that out. For a family of 4, a 30 pack of Costco toilet paper should last 90 days. Amazingly and unexpectedly, it seems all Americans are involved with Toilet Paper inventory management.

We can chuckle a little bit about toilet paper. However, it's not just household products we are taking inventory of.

3 min read

Insurance and Financial Advisors - Help Your Clients Keep Their Money

By Krystal Lockwood on 4/22/20 11:00 AM

Americans are losing out on billions of dollars of personal property – and most of them don’t know it.

Unclaimed property has become a silent wealth killer with a recent New York Times report estimating the total number around $80 billion. Unclaimed property is defined as any financial asset that has been lost or abandoned by its owner and, consequently, resides in a state or federal account.

These assets can range from unpaid wages and pensions to uncashed money orders, unused gift cards and undeposited tax refunds. Among the biggest contributors to unclaimed property are lost life insurance policies.

As a result, life insurance advisors are on the front lines of combating the unclaimed property issue and helping find lost life insurance policies. But with the rise in digital banking and currency, advisors will likely need more advanced tools to ensure clients and their families are claiming all their rightful property.

3 min read

Long-Term & Extended Care Planning & Boomers

By Dan Pierson on 3/26/20 10:00 AM

For a long time, Baby Boomers have been the lifeblood of many finance-based industries, and the financial advisor business is no exception. Baby Boomers, considered to be anybody between the ages of 55 and 75, are perhaps the last generation that practices similar financial habits to the generations that came before them.

They own homes, businesses, and other assets, making them easily the wealthiest generation in American history with an estimated $68 trillion in wealth. And, while pondering our own mortality is never fun, it’s an indisputable fact that, as Baby Boomers continue to age, they will need trusted financial advisors to guide them through the uncharted waters of long-term care as well as complete the transference of wealth to their Gen X and Millennial children when applicable.

From retirement plans to long-term healthcare options and beyond, knowing how to provide valuable and targeted guidance to your Baby Boomer clients will ensure mutually beneficial partnerships for everyone involved. Keep reading to learn more about the importance of long-term and extended care planning and how LegacyShield can be a valuable tool for you, your clients, and their loved ones.

2 min read

How Coronavirus and low interest rates may impact LTC Insurance - and why you may want to act now

By Tom Riekse Jr. on 3/18/20 11:00 AM

From quarantined cruise ships to cancelled conferences (not to mention the stock market), the novel coronavirus has had a significant impact on many peoples lives. At first glance, it would seem like the LTC Insurance business wouldn't be significantly impacted compared to other businesses. Why?

2 min read

What Recent New York Suitability Regulations Could Mean for the Future of Long-Term Care Planning

By Tom Riekse Jr. on 2/25/20 11:30 AM

If you are a producer who writes Life Insurance products with New York clients, including Life/LTC plans, effective February 1st 2020 you need to comply with New York State Department of Financial Security Section 187. The regulations are designed to have life insurance and annuity recommendations be made in the best interest of the client - not the insurance agent. Are these regulations a sign of things to come in more states - and how do they impact long-term care insurance?

Video: The Role of Medicare in Comprehensive Planning

By Senior Marketing Specialists on 2/20/20 10:30 AM

Medicare is a buzzword in the media right now, it seems as though every industry from retail to healthcare, all are targeting this growing demographic.

3 min read

The Secret to Finding More Life Insurance Prospects

By LegacyShield on 2/19/20 10:30 AM

Prospecting is, without a doubt, the most difficult and time-consuming part of the life insurance sales process. And the myriad ways we have to generate leads in our current age of virtual networking and content marketing can make it even less clear where to begin.

Seven Employee Benefits Case Studies

By ARM on 2/6/20 12:15 PM

Advanced Resources Marketing (ARM) offer the following case studies as examples of how you can grow your business using their expertise and assistance. Utilizing Enrollment Firms to Perform Core and Voluntary Enrollments; Value and proper risk spread of utilizing two staggered enrollments; Voluntary Offering to Newly Merged Company; Voluntary Offer to HMO; Case for the Replacement and Paternalistic Engineering Firm.

2 min read

Protecting What Matters Most: Your Loved Ones

By Life Happens on 2/5/20 3:33 PM

It’s Insure Your Love month. And what does that mean? Everyone wants the best for their family, whether that’s a spouse, children, aging parents, really anyone you need to take care of. And the numbers back that up: 81% of Americans believe their family is their most valuable asset, according to the new “Protecting What Matters Most Study,” by Edward Jones and Life Happens.

1 min read

Having a Partner to Help Grow Your Sales

By Carroll Golden on 1/22/20 1:17 PM

(Video) The second session in a series of sessions from the Limited & Extended Care Planning Center. This session was live from the NAIFA Performance + Purpose Conference in 2019.

This session features speakers from LTCIPartners, Advanced Resources Marketing, and ASH Brokerage.

1 min read

Innovation in the Extended and Long Term Care Marketplace

By Carroll Golden on 1/21/20 5:02 PM

The NAIFA Limited & Extended Care Planning Center proudly presents: Innovation in the Extended and Long Term Care Marketplace. One of our live sessions from the 2019 Performance + Purpose Conference.

1 min read

Webinar: Long Term Care Planning - 2019 in Review

By Tom Riekse Jr. on 1/16/20 11:00 AM

Join LTCI Partners Managing Director, Tom Riekse and VP, Pat Bradley for a wrap up of Long Term Care in 2019.

In this 30-minute discussion, LTCI Partners recaps some of this year’s top sales strategies, industry news, carrier highlights and more.

"We'll even forecast what’s to come in 2020 as it relates to Long-Term Care planning."

LTC Client Identifier

By ASH Brokerage on 1/13/20 5:00 PM

One size does not fit all when it comes to planning for extended or long term care. A client in the 40's doesn't "hear" information in the same way as a client in their 50's or 60's. ASH brokerage's brochure offers you targeted approaches for different ages and needs.

Corporate Resolution Example

By ARM on 1/10/20 10:41 AM

View a sample of a corporate resolution. For the full version of the document, please contact ARM.

What is the Secondary Market Potential for Life Settlements?

By GWG Holdings, Inc. on 1/9/20 10:39 AM

2 min read

Managing Long-Term Care Spending Risks in Retirement

By OneAmerica on 1/7/20 10:27 AM

By: Wade D. Pfau, Ph.D., CFA, and Michael Finke, Ph.D., CFP®

All retirees must plan today for the possibility that they will experience significant long-term care health expenditures. Large unplanned expenses, such as those relating to long-term care, have the potential to wreak havoc on a retirement income plan.

3 min read

Optimizing Retirement Income by Combining Actuarial Science and Investments

By Wade D. Pfau, Ph.D., CFA on 12/11/19 1:00 PM